How Bitcoin contributes to financial inclusion and freedom

Bitcoin and other cryptocurrencies are becoming a definite tool for tackling the challenge of financial inclusion and freedom for regions and individuals with limited access to financial and payment tools. It has enabled access to digital payment systems that bypass traditional banking barriers such as collateral, formal employment, and credit histories.

It has also addressed socio-economic factors, bridging gender gaps in financial inclusion, serving underserved regions, and aiding in humanitarian crisis zones, among others. These barriers have historically restricted the ability of individuals and businesses in these areas to save, invest, and grow economically.

Through decentralized finance and the scalability of the Lightning Network, Bitcoin and the wider crypto ecosystem empower individuals with tools for financial autonomy.

What is financial inclusion?

Everyone should have availability and equal opportunities to access financial services, right? That is what financial inclusion refers to. It helps to provide affordable, appropriate, and accessible financial products such as payments, savings, credit, and insurance. These services are crucial for individuals and businesses, especially those who are underserved by the traditional banking sector, including people with low incomes, women, and other socioeconomically marginalized groups.

Globally, approximately 1.7 billion adults remain unbanked, according to the World Bank, without any account at a financial institution or through a mobile money provider. It constitutes about 17% of the global adult population.

The concept of financial inclusion evolved from the microcredit movement of the 1970s and became prominent in the early 2000s. It is now a crucial part of the global development agenda, and Bitcoin is significantly enhancing this movement. How? By offering a viable alternative to traditional banking obstacles, providing direct access to financial tools, and fostering economic empowerment.

Key aspects of financial inclusion:

- Access to financial services— Ensuring that everyone has access to a range of financial services at an affordable cost.

- Financial literacy— Educating individuals about financial products and risks to help them make informed decisions.

- Economic growth— Promoting economic participation and entrepreneurship through access to financial services.

- Social impact— Reducing poverty and inequality by empowering marginalized groups financially.

How Bitcoin contributes to financial inclusion

Born out of the financial crisis of 2008, Bitcoin was created by the anonymous figure or group known as Satoshi Nakamoto as an alternative to traditional banking systems. Its foundational principle is to provide an open, decentralized platform where anyone, regardless of geographic location or economic standing, can participate in the financial system. This makes Bitcoin a potent tool for financial inclusion.

These are key mechanisms through which Bitcoin fosters inclusivity:

Decentralized payments

Bitcoin enables decentralized financial transactions. This means that users can send and receive money without the need for traditional banking intermediaries. It is particularly beneficial in regions where banking infrastructure is weak or nonexistent.

The Lightning Network

As an overlay network to Bitcoin, the Lightning Network allows for instant, low-cost transactions. This scalability solution makes Bitcoin practical for everyday transactions, such as buying groceries or paying bills, even in regions where financial services are limited.

Empowerment through microfinance

Bitcoin facilitates microloans and other forms of microfinance directly to entrepreneurs and small businesses. By resolving the limitations of traditional financial institutions, which often deem these ventures too risky or too small to service, Bitcoin enables economic opportunities at the grassroots level.

Reducing remittance costs

For many in developing countries, receiving money from family abroad is a main resource for enabling dignified living, but it is costly due to the high remittance fees of traditional banks and services built around fiat currencies. Bitcoin is drastically reducing these costs, making it cheaper for migrant workers to send money home, thus supporting their families more effectively.

Access to global markets

By using Bitcoin, businesses and entrepreneurs in remote areas can engage with global markets more easily. This not only opens up new growth opportunities but also helps integrate them into the global economy, enhancing overall economic resilience and access to wide-ranging services.

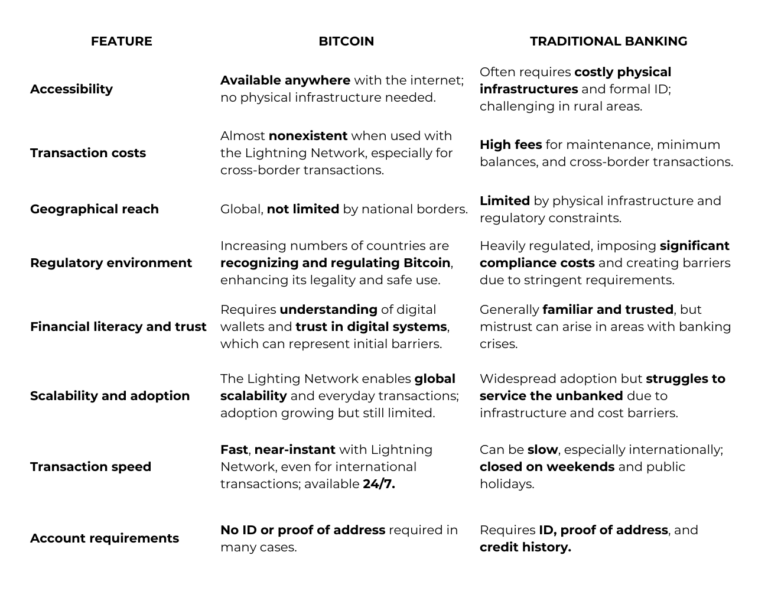

How does Bitcoin compare to traditional banking in terms of financial inclusion?

While traditional banking systems have served as the backbone of global finance, they often come with barriers that can exclude vast segments of the population. Bitcoin, with its decentralized nature, presents a contrasting model that inherently promotes inclusivity.

Real-world examples of financial inclusion thanks to Bitcoin

Closing Africa’s gender financing gap

Fintech innovations related to Bitcoin and cryptocurrencies are dramatically reshaping Africa’s financial landscape, offering unprecedented access to banking services. Companies leverage digital solutions like mobile banking and peer-to-peer lending, which are crucial in regions where traditional banking infrastructure is lacking.

Notably, initiatives like those by RealFi, which primarily utilize blockchain and cryptocurrencies, have disbursed over 2 million loans, 65% to women-owned businesses in Kenya, Uganda, and Rwanda, demonstrating lower default rates and quicker repayment times among women.

Bitcoin’s legal tender in El Salvador

In 2021, El Salvador made history by adopting Bitcoin as legal tender, a landmark decision aimed at enhancing financial inclusion. This policy enabled Salvadorans, particularly the 70% of the population without access to traditional banking services, to engage in the economy through Bitcoin transactions. It has reduced remittance costs significantly, which is vital since remittances constitute a major portion of the country’s GDP.

Although it did not have the expected adoption and effect on the local economy, by integrating Bitcoin into daily transactions, El Salvador pioneered a model that showed the world how cryptocurrencies can play a role in economic development and financial inclusion.

Empowering Colombian entrepreneurs

While Bitcoin has been a trailblazer in utilizing blockchain for financial inclusion, other cryptocurrencies have followed suit, broadening the scope and application of this technology. A notable example is the Decaf project in Colombia, which offers a non-custodial wallet that simplifies money transfers and enables easy entry into decentralized finance, making financial services accessible to a local community recovering from some of the Colombian conflict’s worst violence in the early 2000s.

This allows the community to transfer funds securely and to engage in savings and investments, fundamentally changing how they manage finances and plan for the future.

Examples like this demonstrate how Bitcoin and the broader blockchain technology can create robust financial ecosystems that support local economies and community empowerment.

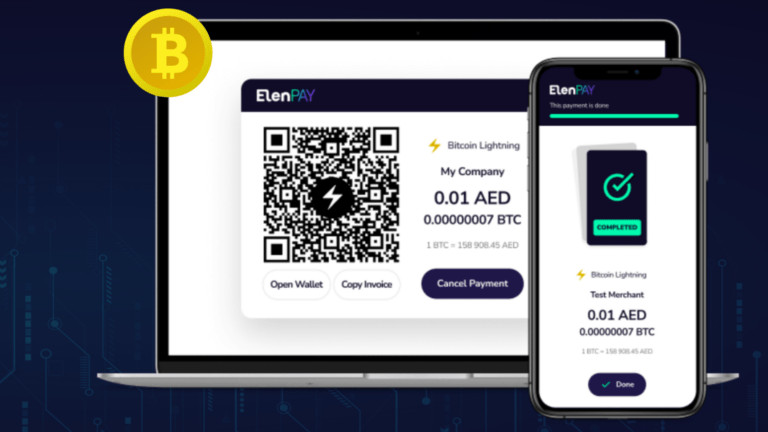

ElenPAY’s commitment to financial inclusion

ElenPAY is committed to enhancing financial inclusion and freedom by empowering businesses to offer everyday Bitcoin payment options through the Lightning Network.

Our Bitcoin payment processor offers multiple benefits to businesses worldwide:

- Bypasses traditional financial barriers, facilitating access to products and services for individuals globally.

- Meets business needs efficiently with instant and low-cost transactions.

- Eases international operations, eliminating the usual complications.

- Enhances financial security and reduces fraud risk with secure and irreversible transactions.

By adopting ElenPAY’s PSP solution, businesses not only expand their market reach but also help democratize economic participation. This approach allows individuals in remote regions to engage with the global economy more freely, promoting a more inclusive financial ecosystem.

Join us in our mission to expand financial inclusion, enabling broader access to financial services and contributing to a more equitable global economy.