Bitcoin payment gateways: A guide for iGaming

If you are running an iGaming business, you know that offering the right deposit options can make a huge difference in player satisfaction. Bitcoin payment gateways provide a seamless way to accept crypto payments. However, in iGaming, it’s important to consider the extra regulatory factors.

Since most jurisdictions don’t allow operators to hold cryptocurrencies directly, operators should work with specialized gateways that convert Bitcoin into fiat instantly, ensuring compliance while enjoying all the benefits of crypto payments.

What are Bitcoin payment gateways?

Bitcoin payment gateways act as a bridge between businesses and cryptocurrency users. They process transactions, verify payments, and can also convert Bitcoin into fiat currency. This setup ensures that companies can accept Bitcoin payments without having to deal with price volatility or complex crypto management.

Due to regulations, most online casinos and betting platforms must avoid handling digital assets directly. But this doesn’t mean they cannot offer Bitcoin payments to their players. A well-chosen Bitcoin payment gateway helps operators stay compliant while giving players the possibility of depositing with Bitcoin.

How do Bitcoin payment gateways work in iGaming?

By streamlining Bitcoin transactions and mitigating risks, Bitcoin payment gateways allow iGaming platforms to tap into a growing base of crypto-savvy users while maintaining operational efficiency. Here’s how:

- 1) Player Deposit Request: First, the player selects Bitcoin as their deposit method and initiates the transaction.

- 2) Transaction Processing: The payment gateway verifies the transaction, and can apply KYC (Know Your Customer) and AML (Anti-Money Laundering) checks to ensure compliance.

- 3) Volatility Management: The gateway uses hedging mechanisms or converts to USDT in the Lightning Network to stabilize conversion rates and avoid volatility.

- 4) Player Access to Funds: Once the transaction and conversion are confirmed, the player’s account is credited with the equivalent fiat balance, allowing them to start playing right away.

- 5) Security & Fraud Prevention: Some gateways, like ElenPAY, offer KYT (Know Your Transaction) tools and anti-fraud monitoring to detect suspicious activity.

- 6) Settlement Request: Operators can request settlements anytime, ensuring that fiat funds are securely transferred to their bank accounts.

Why should iGaming operators implement Bitcoin as payment?

Implementing an additional payment gateway is always a good idea, as it’s an extra option for players to pay within your platform. Adding a Bitcoin payment gateway, especially when operated via the Lightning Network, comes with even more benefits:

- Lower transaction fees: Bitcoin transactions through the Lightning Network have near-zero fees, improving profitability.

- Faster transactions: Deposits and withdrawals via Bitcoin settle in minutes, and when used via the Lightning Network, they settle instantly, keeping players engaged.

- Global reach: Bitcoin removes barriers for players in regions where traditional banking options are limited or expensive.

- No chargebacks: Unlike credit cards, Bitcoin transactions are irreversible, reducing fraud and chargeback-related disputes.

- Enhanced privacy: Many players prefer Bitcoin because it offers a higher level of financial privacy compared to bank transfers.

Considerations when choosing a Bitcoin payment gateway

Choosing the right Bitcoin payment gateway requires balancing security, compliance, and ease of use. Here are some factors you should consider:

- Regulatory compliance: Ensuring the gateway follows KYC/AML standards and is MiCA-compliant avoids legal hurdles.

- Security features: Look for fraud detection, encryption, and transaction monitoring to protect both players and the platform.

- Instant fiat conversion: A must for iGaming operators in jurisdictions that don’t allow to handle crypto directly.

- Easy integration: The gateway should work smoothly with your existing platforms and payment systems.

- Technical support: Technical issues need quick resolutions, and having someone ready to help 24/7 is essential.

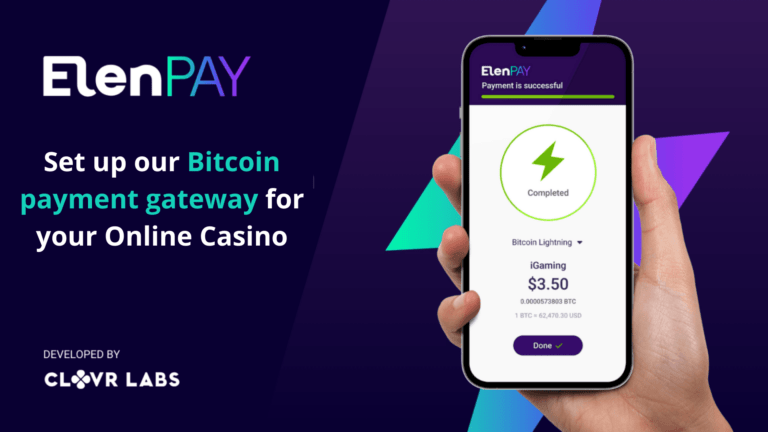

Why choose ElenPAY for your Bitcoin payments?

ElenPAY is built specifically for regulated operators in iGaming, offering them a compliant and secure way to accept Bitcoin payments through the Lighting Network. Here’s why our clients choose our platform:

- Regulation comes first: Our platform fully adheres to MiCA, KYC, and AML requirements, keeping operators in the clear legally.

- Fast transactions and near-zero fees: ElenPAY uses the Lightning Network for all deposits and withdrawals.

- Instant fiat conversion: No need to worry about handling Bitcoin. ElenPAY converts it to fiat instantly.

- Easy integration: Our APIs and widgets will save you development efforts, speeding the integration up.

- 24/7 customer support: You’ll always have the hand you need, whenever you need it.

With ElenPAY, you get the best of both worlds—all the benefits of accepting Bitcoin while being fully compliant with current and future regulations. Schedule a demo today to experience how easy it is to add Bitcoin payments to your platform.

Bitcoin payment gateways FAQs

Bitcoin payment gateways are legal if they adhere to jurisdiction-specific licensing, AML/KYC, and consumer protection frameworks. The lack of global harmonization and shifting enforcement priorities demand continuous compliance adaptation, so working with reputable and regulated providers is essential.

Yes, they can be safe to use if they implement robust security measures and users follow best practices. Choosing a reliable provider should be a priority. The best gateways use encryption, fraud detection, and compliance tools to keep transactions secure.

A Bitcoin payment gateway is designed for businesses to process customer payments and manage settlements. A Bitcoin wallet is used by individuals to securely store cryptographic keys and interact with the Bitcoin network, sending and receiving funds without intermediaries.

They offer innovative solutions but require businesses to navigate volatility, security threats, regulatory ambiguity, and operational complexities. However, working with a reliable payment gateway like ElenPAY reduces these challenges.